The last thing an investor needs in a commercial due diligence is a consultancy that „boils the ocean“. Or deploys junior resources with great analytical skills, but limited understanding of and insights into the target’s industry and business. Getting it wrong and getting it late are not an option in competitive due diligence processes.

Our analysis and recommendations in a due diligence are focused, thorough and comprehensive.

We combine deep industry expertise with the analytical tool kit of a leading consultancy to get to substantiated insights faster and with less fuss.

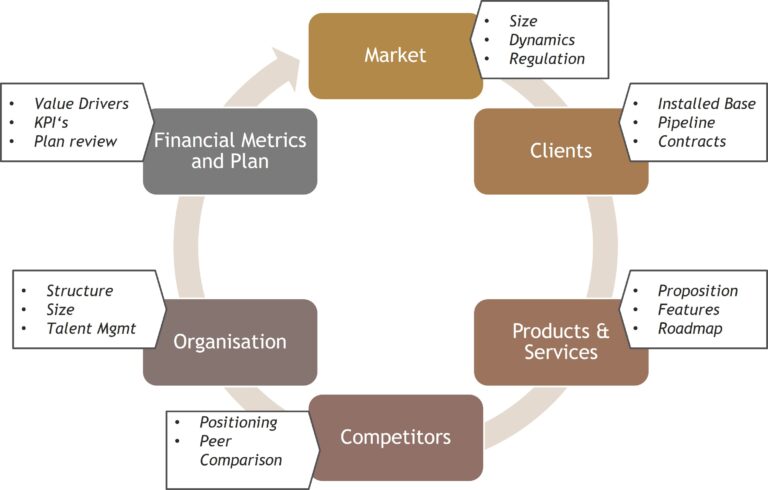

Our commercial due diligence analyses all relevant aspects of a business: Markets, clients, products & services, competition, organisation and financials.

We deliver investment committee-ready analysis, insights and „so what’s“ on these subjects. We highlight further issues to probe and validate during the ongoing due diligence process.

Learn more about how we support every single step in the commercial due diligence: